VCC or Virtual Credit Card is a prepaid credit card or you can also call it as a debit card because there’s no credit facility on it actually. These virtual cards are good for online usage as even if the card information is compromised, the hacker cannot use them beyond the loaded balance and the preset daily usage limits.

These days a lot of online wallets are offering a virtual credit card to make their wallets more flexible and usable across multiple merchants. Even the banks are offering disposable one-time prepaid cards to their customers to keep them safe from frauds. Here’s a look at some of these services which offer a free virtual card or in some cases even a physical card to their users.

Contents

Apps & Services Providing Virtual Cards

The following apps and services are open for just anyone to use. The most one would need is a dedicated account on the specific service which can be instantly opened by providing a few details.

1. Pockets Wallet by ICICI Bank

Pockets is a convenient wallet service backed by the trust of ICICI bank. Anybody can signup and make use of Pockets wallet and being an ICICI Bank customer is no compulsion. A free virtual visa credit card is offered with the wallet which can be used to make payments across all online merchants in India. Other than that, Pockets also offers an option to get a physical card link to the wallet, however, the yearly fees applies for that. The advantage of a physical card is that it can then be used at offline retailers as well.

Pockets also brings a range of shopping offers from time to time, some of them which are exclusive to users of the Pockets card.

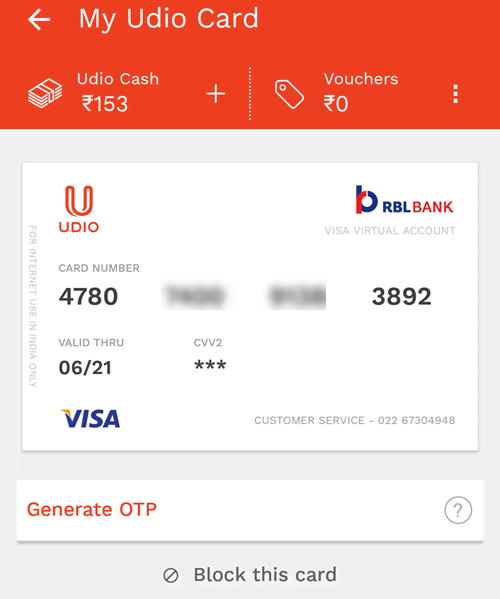

2. Udio Wallet

Udio is a new age wallet, similar to ICICI pockets. The wallet offers a free virtual visa card which can be used on nearly all online stores in India. Udio also provides a physical card for a fees (which varies from time to time). Having a physical card allows you to shop at offline merchants as well. Both the virtual card as well as the physical card are issued by Udio in partnership with RBL Bank. Udio continues to run numerous promotions which can be availed by customers to earn cashback or special discounts.

Money can be loaded into Udio wallet via a credit/debit card or Netbanking of your bank. You can also make use of an Udio cashpoint to load your wallet using cash. However, the cash points are rare and not available everywhere.

Udio supports all standard features of a digital wallet, such as: sending or receiving money from other udio users & withdrawing money to a bank account.

3. Slonkit

Slonkit does not offer a virtual card, instead a physical card, I’m still keeping it here because it is a nice offering. Slonkit is targeted at parents having young children. It offers a free prepaid Visa Credit Card which is re-loadable by using the Slonkit app. The idea is to teach money management to youngsters. The app offers mobile recharges, tracking of spends (card transactions) and the creation of budgets for money-saving. The app also bundles a range of offers from various merchants.

Although targeted at children and parents, the service can be used by anyone (18+ users are supported too) to get a free visa debit card which is re-loadable as per wish and usable anywhere across India, online and offline. The cards can be instantly blocked for when some theft happens. However, it is not possible to withdraw money from an ATM using Slonkit Visa cards.

4. Lime Wallet by Axis Bank

Lime wallet by Axis Bank is a wallet service similar to Pockets wallet by ICICI Bank. A free virtual credit card (called Shopping Card) powered by MasterCard is offered to the users of wallet service. The card can be used at any online merchant in India with no international usage allowed.

Lime wallet by Axis Bank is a wallet service similar to Pockets wallet by ICICI Bank. A free virtual credit card (called Shopping Card) powered by MasterCard is offered to the users of wallet service. The card can be used at any online merchant in India with no international usage allowed.

Although not available yet, Axis Bank is working on offering a physical card connected to the wallet which will make it possible to shop at offline stores.

5. Union Bank Digipurse Wallet

Union Bank also offers its wallet service similar to Pockets wallet. The app is more of a virtual bank account which can be loaded from a normal credit/debit card and then the wallet’s card can be used to make payments anywhere, domestic or international. Yes, international. Know more about Digipurse Wallet here.

6. Oxigen Wallet Prepaid Card

Oxigen Wallet is a popular wallet app which is known for running exclusive cashback offers from time to time. The oxigen wallet offers a free virtual visa card which can be used to make purchases on any shopping portal within India. Know more about Oxigen Wallet here.

7. Entropay Virtual Visa Card

Not based in India, but Entropay has been around since long. The service offers free virtual visa cards which are international. Although they do carry a high loading commission, but Entropay is probably the only virtual card service which is open to anybody and is usable internationally. You can generate any number of cards and can even transfer funds from one card to the other.

Entropay does not support the 3D verification (VBV/MSC) and hence majority of Indian merchants will not accept it. Know more about Entropy here.

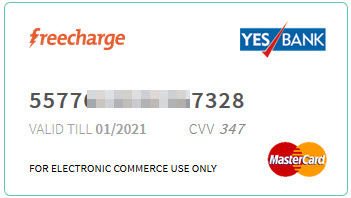

7. FreeCharge Go MasterCard (Temporarily Unavailable)

Update: FreeCharge Go card is unavailable for a few months already. We do not know when or if ever it will come back.

FreeCharge is an online recharge and bill payment facility which is now owned by Snapdeal. Recently freecharge expanded the usability of its wallet by offering users a free virtual card (called Freecharge Go card) powered by Yes Bank and MasterCard which can be used across any online merchant; eBay, Flipkart, Snapdeal, Amazon or anywhere you want to. 3D code authentication is done during the card usage by sending an SMS to the phone number registered with FreeCharge.

To get the card,

- Signin to FreeCharge account or create a new account.

- Go to Account section and choose FreeCharge Go MasterCard.

- Enter a 4 digit PIN and your card is ready.

- Load your wallet and start using!

Virtual Cards Provided By Banks

Besides the services listed above, there are many banks which offer virtual card services to their customers. Most of these cards are use-and-throw types and automatically expire after 1 transaction or 24-48 hours.

1. Kotak Mahindra Bank Netcard

Kotak Mahindra Bank customers can avail the free Kotak NetCard (or Netc@rd). The service is powered by Enstage and the provided VCCs only work internationally as they do not support secondary verification in the form of 3D secure code. If you want to shop or pay for something to international merchants who do not need 3D authentication, Kotak NetCard is a nice option. It cannot be used on PayPal due to its limit of only 1 successful transaction.

2. SBI Virtual Card

State Bank of India customers can log into their NetBanking account to generate free virtual cards starting from ₹100 up till ₹50,000. The card expires after 1 successful transaction and/or 48 hours since card creation. SBI virtual cards can only be used domestically, Transactions are approved by sending a text to your registered mobile number.

3. HDFC Bank NetSafe

HDFC Bank also offers virtual credit cards to its customers through its NetSafe interface. The lifetime of the card is 48 hours of 1st transaction (whichever is earlier).