Cricketing season is around and if you too are a cricket fan, you’d have noticed TV advertisements of Oxigen Wallet’s prepaid credit card which is claimed to protect you from online frauds and thefts. Although Oxigen Wallet is not the only one offering prepaid/virtual credit cards, it is a good alternative as you can create as many cards as needed. So here’s a detailed look at how the Oxigen Wallet’s Visa prepaid cards work and their features and advantages.

Cricketing season is around and if you too are a cricket fan, you’d have noticed TV advertisements of Oxigen Wallet’s prepaid credit card which is claimed to protect you from online frauds and thefts. Although Oxigen Wallet is not the only one offering prepaid/virtual credit cards, it is a good alternative as you can create as many cards as needed. So here’s a detailed look at how the Oxigen Wallet’s Visa prepaid cards work and their features and advantages.

Contents

What are Oxigen Wallet’s Prepaid Visa Cards?

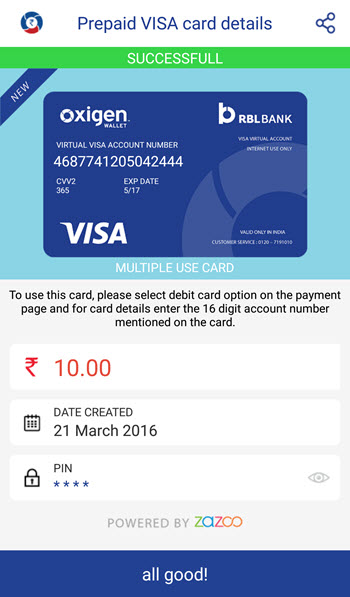

The prepaid cards offered by Oxigen Wallet work just the same way as a normal debit card does, with the exception that there is no physical card in this case. Prepaid cards come with the usual 16-digit card number, expiry date and a CVV/CVV2 code which can together be used to make payments at any online retailer in India which accepts Visa cards. The cards are powered by RBL bank

Advantages of the Oxigen Prepaid Card

The obvious advantage here is that you do not disclose the details of your credit/debit card on suspicious websites, hence protecting yourself from frauds and theft of information. The maximum that can be withdrawn is the amount loaded in the respective prepaid card and in case the card information is compromised, nobody can empty your bank account.

Further, you can create an unlimited number of these prepaid cards and there is no fees associated with creating or using the Oxigen wallet virtual cards. A card once created cannot be reloaded after using the funds out of it, hence making these cards like a use and throw debit card which is 100% free.

Parents can also use these cards to let their teen children make payments for small purchases on their own. This way the parents will not have the fear of card details being mishandled by the child.

Get Started

To start using the Oxigen Wallet’s prepaid Visa cards, you need to download and install the Oxigen Wallet app to your smartphone from the respective app store of your platform. Launch the app, create a new Oxigen wallet account (or log into an existing account) and tap the Prepaid Card option on the main screen.

Once a card is created, you can make payments, share it with your friends, view the list of transactions which were done using that card and delete the card as well. If you delete a card which still has some balance left, it will be credited to your RBL (not Oxigen Wallet) account and can only be used to create a new virtual card.

To make payment at a merchant, enter the full card number, expiry and CVV2 code. Then use the PIN to complete the Verified by Visa.3D authentication by entering the 4-digit PIN created during card creation. If you forget the PIN code, you need to delete the card and create a new one with a new PIN code.

Oxigen Wallet Offers Much More

Besides offering the prepaid visa cards, Oxigen wallet offers a range of monetary services, such as mobile/DTH recharges, bill payments, sending and receiving money, asking for money; etc. Other than that, you can pay directly via Oxigen wallet to certain approved online and offline merchants. Oxigen wallet is approved by RBI and is powered by Oxigen Services India Pvt. Ltd which is India’s first and largest payment solutions provider.